In Nigeria, United Bank of Africa Plc (UBA) is a leading financial service provider with its headquarters in Lagos.

The company was founded in 1989 by the founders of the African Development Bank (AfDB).

United Bank of Africa (UBA) provides universal banking services to more than 7.2 million customers through 700 Business Offices in 19 African nations, as well as through representative offices in New York, London, and Paris.

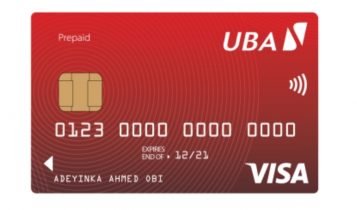

If you have no idea on what a UBA Africard is all about, we have just the publication you are looking for.

We delivered a well explained article on Everything you need to know about the UBA Africard, you can click here to learn more.

Key Takeaways

- United Bank of Africa (UBA) provides universal banking services to more than 7.2 million customers.

- UBA has increased the monthly international spending limit on its debit and prepaid Naira cards from $100 to $2,000.

United Bank of Africa (UBA) Plc, a pan-African banking institution, has announced an instant increase in the monthly international spend limit on its debit and prepaid Naira cards from $100 to $2,000.

The increase is effective immediately.

As a result of the revision, which marks a significant rise of 1,900 percent, consumers can now withdraw up to $2,000 each month, as opposed to the prior limit of $100, under certain conditions.

Customers who conduct international transactions, according to the bank, have increased their demand for higher credit limits.

This has prompt the bank to take this action.

UBA Increases International Spend Limit on Naira Cards

The growth in foreign exchange in the financial system is also an indication of greater confidence in the Nigerian economy, as seen by the increase in foreign exchange in the financial system.

The growth in foreign exchange in the financial system is also an indication of greater confidence in the Nigerian economy, as seen by the increase in foreign exchange in the financial system.

Mr. Chukwuma Nweke, Executive Director, Operations & Technology, United Bank for Africa, who announced the review, noted that the change is intended to make purchasing goods and services outside the country more convenient and seamless.

“This is in respect of the demands and expectations of our clients,” he explained. “The new limit has been put into effect.”

As a result of the comprehensive review, clients will now be able to conduct increased cross-border transactions priced in foreign currency using their debit and credit cards.

Which will result in higher customer satisfaction, according to Nweke

As a result of this change, clients will be able to complete more transactions with more comfort and at their leisure, according to him.

“This provides our customers with the ability to make foreign payments using our POS and Web systems.”

Additionally, you can withdraw money from an ATM up to the current daily maximum of $100.

“This only goes to show that our customers are at the heart of our business, and our unwavering commitment to providing them with nothing short of unrivaled service will not be compromised,”

He continued.

“We are committed to providing outstanding and long-term service delivery that is distinctively UBA.”

UBA’s customer-centric approach is centered on the continuous development of new, technological, and customer-driven services to improve customer satisfaction.

UBA International Spending Limit Quick Recap

A leading pan-African financial services group with operations in 19 African countries, as well as the United Kingdom, the United States of America, and France.

Has Recently increased their Daily and Monthly spending limit to help cater for the needs of their customers.

Recommended Articles:

- What is UBA Africard? Everything you Need to know before Getting One

- Simple UBA SWIFT (BIC) code: What is it and Everything You Need to know

- PayPal Report: Did PayPal Block UBA Africard?

- PayPal: Complete List of Countries/regions with the ability to send payments

Didn’t find what you were looking for? Use the search button.

Thanks for letting us know about this. But how recent is this info?

This article was last updated on march, it’s possible there must have been a modification on the new international limit like other banks just recently did. Kindly verify from your bank or account manager

Thank you for the elaborate article, I appreciate the effort for presenting all the info, really thank you.