We understand the concerns that arise when it comes to late regularization, and we’re here to provide clarity on the matter. In this article, we will explore whether there are any penalties associated with late regularization. By delving into this topic, we aim to help you navigate the potential consequences and guide you towards a better understanding of the situation. Let’s dive in and shed some light on this important issue.

Is There A Penalty For Late Regularization?

This image is property of www.analyticssteps.com.

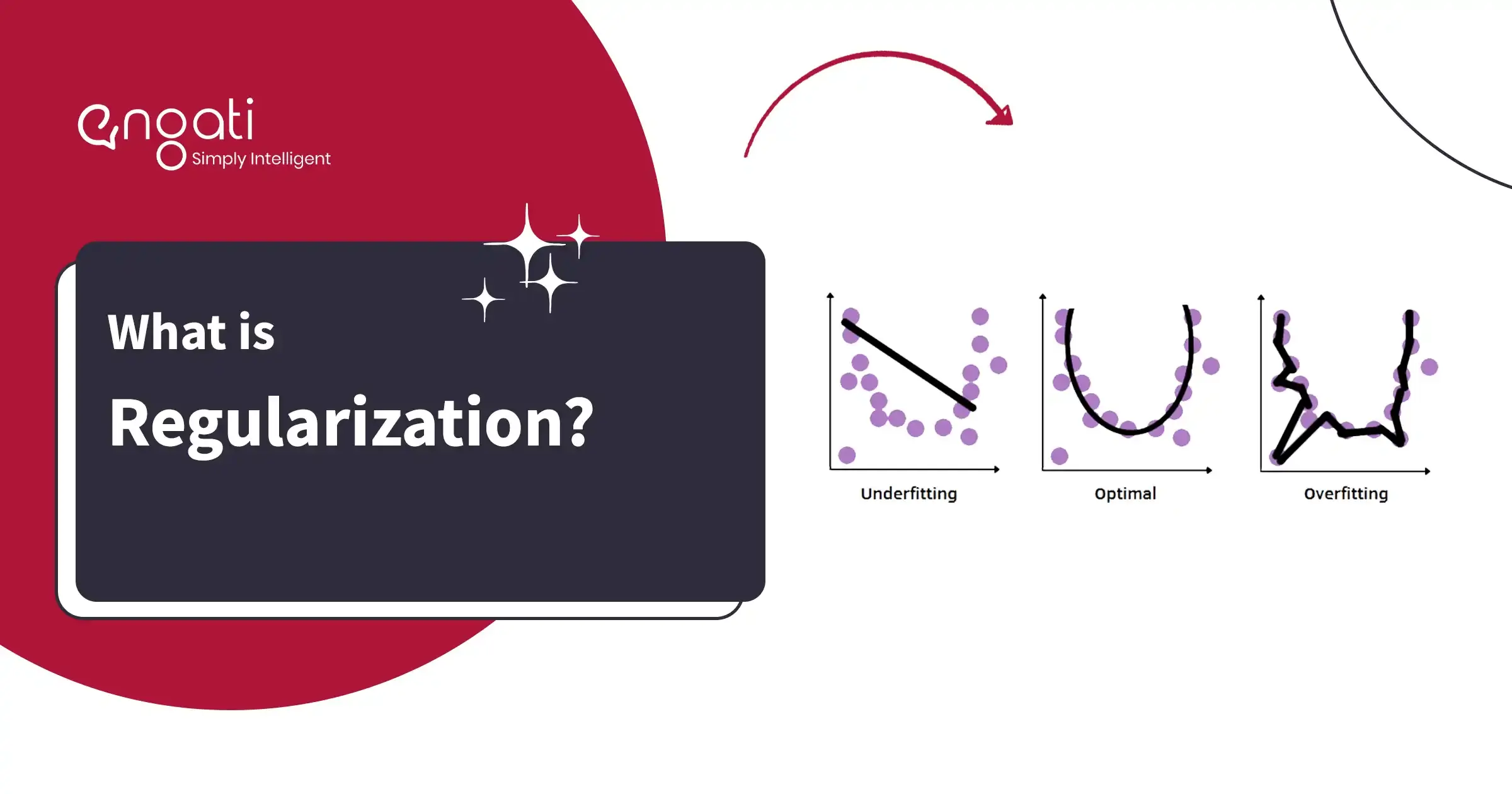

What is regularization?

Regularization refers to the process of organizing and updating necessary paperwork and documentation to ensure compliance with regulations set by governing bodies. This process is typically required for various aspects of business, such as employee records, tax filings, licenses, permits, and other legal obligations. By regularizing these documents, businesses can ensure that they stay in line with legal requirements, maintain transparency, and avoid potential penalties or legal consequences.

Understanding the concept of late regularization

Late regularization occurs when the necessary paperwork or documentation is not completed within the specified timeframe set by the governing bodies. This can happen due to various reasons such as oversight, lack of awareness, or simply being overwhelmed with other responsibilities. While late regularization is common, it is important to understand the potential consequences and penalties that may arise from such delays.

The importance of timely regularization

Timely regularization is crucial for various reasons. First, it ensures compliance with legal requirements, helping businesses avoid potential penalties. Second, it promotes transparency and accountability, both internally and externally. By regularly updating documents and records, businesses can maintain accurate information and demonstrate their commitment to transparency, which can enhance their reputation among stakeholders. Lastly, timely regularization helps businesses stay organized, minimizing the risk of errors, data loss, or confusion.

Possible penalties for late regularization

Late regularization can result in penalties imposed by governing bodies. These penalties can vary depending on the nature of the late regularization and the specific regulations involved. Common penalties may include financial fines, suspension or revocation of permits or licenses, legal action, or additional requirements to rectify the non-compliance. It is important to note that penalties can accumulate over time, making timely regularization even more essential.

This image is property of laid.delanover.com.

Legal consequences of late regularization

In addition to financial penalties, late regularization may have legal consequences. Failing to regularize within the specified timeframe can result in legal action, lawsuits, or disputes, depending on the severity of the non-compliance. This can lead to significant costs, damage to a business’s reputation, and potential loss of business opportunities. It is critical to understand the legal implications of late regularization and take proactive measures to avoid such situations.

Tips to avoid late regularization penalties

To avoid penalties and legal consequences associated with late regularization, businesses can implement several strategies:

-

Stay updated: Regularly review and familiarize yourself with the relevant regulations and deadlines. This will help ensure you are aware of any changes and can plan accordingly.

-

Set reminders: Use calendars, task management tools, or software to set reminders for upcoming deadlines related to regularization. This will help you stay on track and complete the necessary paperwork on time.

-

Seek professional assistance: If you are unsure about the requirements or process of regularization, consider consulting with professionals such as lawyers, accountants, or compliance experts. They can provide guidance and ensure you meet all necessary obligations.

-

Create an internal system: Establish an organized system within your business to manage and update required documents. This can include assigning responsibility to specific individuals, creating a checklist, or implementing document management software.

-

Regularly review internal processes: Conduct periodic audits or assessments to identify any areas where regularization may be lacking or delays may occur. By proactively addressing these issues, you can minimize the risk of late regularization.

This image is property of global-uploads.webflow.com.

Common reasons for late regularization

Late regularization can occur due to a variety of reasons. Some common reasons include:

-

Lack of awareness: Businesses may not be aware of the specific regulations or deadlines they need to comply with, resulting in unintentional late regularization.

-

Administrative oversight: With numerous responsibilities to manage, administrative tasks related to regularization may be overlooked or forgotten.

-

Prioritization: In some cases, businesses prioritize other tasks or projects, leaving regularization as a lower priority. This can lead to delays and potential penalties.

-

Complexity: The process of regularization can be complex, involving multiple steps, forms, and approvals. This complexity may cause delays, especially if businesses are unfamiliar with the process.

Consequences of non-compliance with regularization deadlines

Non-compliance with regularization deadlines can have significant consequences for businesses. Apart from financial penalties and legal action, non-compliance can tarnish a business’s reputation, lead to customer distrust, and damage relationships with stakeholders. It may also affect eligibility for government grants, contracts, and opportunities. To avoid these consequences, businesses must prioritize timely regularization.

This image is property of miro.medium.com.

Comparison of penalties in different industries

Penalties for late regularization vary across industries and jurisdictions. Each industry may have its specific regulations and penalties for non-compliance. It is crucial for businesses to research and understand the penalties applicable to their industry. Additionally, penalties may also vary based on the severity of the non-compliance and the governing body responsible for enforcement. Businesses should consult with legal and compliance professionals to obtain accurate and up-to-date information on penalties specific to their industry.

Examples of penalty amounts for late regularization

Penalty amounts for late regularization can vary significantly depending on the specific non-compliance, governing bodies, and jurisdictions. For example, late tax filing penalties can range from a fixed amount or a percentage of the tax owed. License or permit-related penalties can include fines, license suspension, or even criminal charges in some cases. It is essential for businesses to research and understand the potential penalty amounts applicable to their specific situation and take necessary steps to avoid them.

In conclusion, late regularization can lead to penalties and legal consequences. Timely regularization is crucial for maintaining compliance, transparency, and avoiding potential penalties. By staying updated, setting reminders, seeking professional assistance, creating internal systems, and reviewing processes regularly, businesses can minimize the risk of late regularization and its associated consequences. Understanding the common reasons for delays and the potential penalties specific to the industry is essential for ensuring compliance and avoiding penalties.

This image is property of ars.els-cdn.com.

Didn't find what you were looking for? Search here